Everywhere I go people are asking what’s going to happen with construction prices, and they are right to ask. I visited with a prospective client this month and he told me that construction prices on his prototype increased 46% in two years, which was shocking to him and a little surprising to me. We are tracking prices in our Florida office and our records indicate costs are up 30% in 14 months, 2% per month, so I guess I shouldn’t have been surprised. Everywhere we look subcontractors are backing out of quotes and/or raising prices, and even once under contract don’t always honor prices. Materials and labor availability is a whole other issue. It’s hard to believe these increases can continue, but I don’t see any signs of relief.

The above doesn’t make our jobs any easier or more enjoyable. We hate giving bad news to our clients on costs, but when you have interest rate increases on top of cost increases it gets really concerning. Thirty year mortgage rates started this year at 3.1%, and are now about 5%, a 60% increase in interest expense for home purchasers. The Fed has finally gotten on board that inflation isn’t “transitory” and that they need to deal with it, and is projecting significant increases in their interest rates over the next year and a half, which is reflected in current bond prices. The two year government bond rate has inverted briefly a couple of times with the ten year bond rate, which is an indicator that a recession is a potential.

Demand for new homes with resultant demand on construction resources is creating much of the price increases. One needs to ask how long housing demand will continue at this rate with cost and mortgage rate increases. I’m expecting that mortgage rates will continue up for a period of time and we can’t do anything about that. Many clients are asking when prices will come down because the inflation we’re seeing in our industry, which greatly outpaces that in the general economy, can’t be sustainable, and shouldn’t continue.

The best predictor of the future is the past, possibly. A review of the last two recessions through Turner Construction’s Building Cost Index shows that prices never decreased in the recession that occurred in 2002 and 2003. However during the not so great recession of 2009 through 2010 costs went down 12.4%. Pretty good, huh? But that was after prices rose 39% in the four previous years. So the question one must ask is how bad will a recession, with a reduction in demand compare to the great recession. I fear that the falloff in construction could be significant given the double impact of cost and interest rate increases, so a 5% reduction in construction costs isn’t out of the question.

As I am talking to clients I’m encouraging them in their own best interest to try to make things work now, because a 5% reduction doesn’t help if interest rates go up two points, for example, increasing interest expense dramatically. The other question has to be when costs might start to decline. In my mind, it’s tied to a housing slowdown. My guess is we are still 12 to 15 months out. The future is uncertain, and I welcome anyone’s thoughts on this because it’s important to our clients and us.

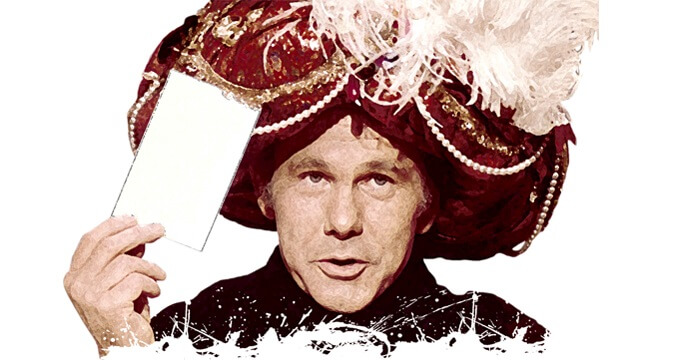

Peter Douglas

President

Read More >