The Douglas Company has done a lot of work on developing Mid-market senior living prototypes that are cost-effective, functional and durable. Though we have expertise in senior living construction, we are not experts in the operations of these communities. So while we can attack the cost of the physical plan, which is really is only 10% of revenue, it's a small part of the solution.

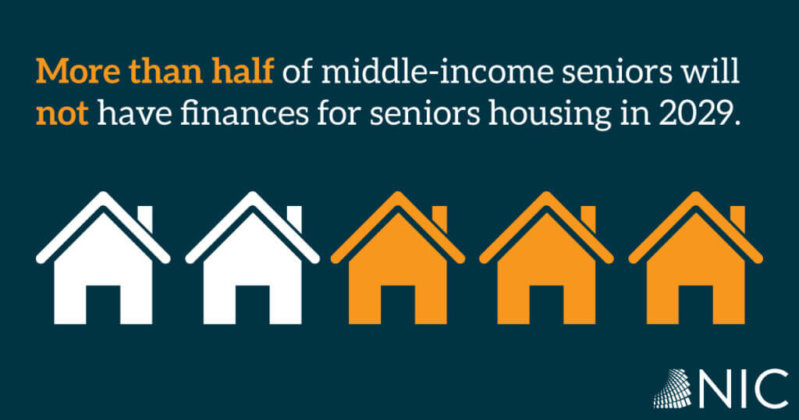

At the NIC Conference, people talking about how to serve the mid-market, but only one had a prototype. It was intriguing and thoughtful and we are studying it further, but there was limited other focus on this market from what I saw. NIC had a session specifically devoted to this, and there were a number of statistics I wouldn’t normally consider impacting current and future demand for this product, such as the changing demographics related to marital status, location relative to children, changing health-related factors, and...

Read More >