The Douglas Company has done a lot of work on developing Mid-market senior living prototypes that are cost-effective, functional and durable. Though we have expertise in senior living construction, we are not experts in the operations of these communities. So while we can attack the cost of the physical plan, which is really is only 10% of revenue, it’s a small part of the solution.

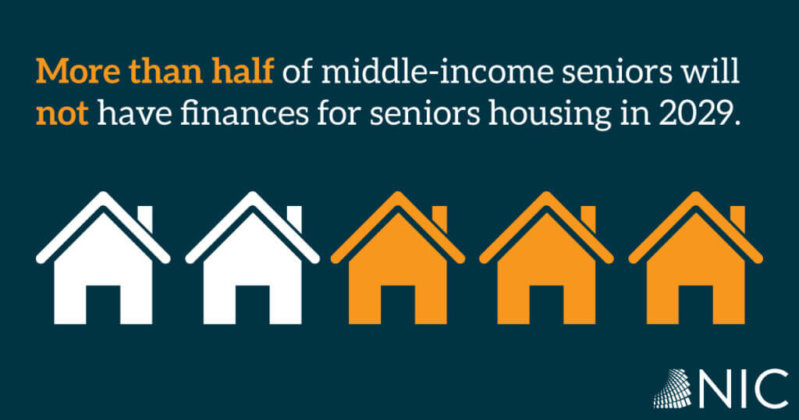

At the NIC Conference, people talking about how to serve the mid-market, but only one had a prototype. It was intriguing and thoughtful and we are studying it further, but there was limited other focus on this market from what I saw. NIC had a session specifically devoted to this, and there were a number of statistics I wouldn’t normally consider impacting current and future demand for this product, such as the changing demographics related to marital status, location relative to children, changing health-related factors, and others that indicate demand will increase dramatically.

Yet despite the record attendance and the enthusiasm for the senior living industry, very few were discussing it. NIC did a study that was convincing, but what they didn’t say, because it wasn’t part of the study, is that the upper end is growing faster than the middle. We read a fair amount in the press and see more independent living being built, and clients trying to do senior apartments (active adult?). But the operating margin seems to be in upper-end projects, which the industry is used to, so I see the mid-market roll out as slow. Being from the Midwest, we tend to be more conservative, frugal, and everything we do here must be close to the end of the economic cycle, so I like the mid-market. When the economy shrinks, people have less money and gravitate to value solutions. And the higher margins without occupancy don’t do much good.

Peter Douglas, P.E.

President

The Douglas Company